Please be informed that the application for the E - voucher of SME Corp Malaysia by the Small and Medium Enterprises ( SME ) will expire on the 10th.

November 2014 at 12.00midnight. After this date, all GST registered persons will be given the E - Voucher worth RM1,000 automatically upon successful

GST registration.

E - vouchers will be sent by SME Corp Malaysia via e - mail to SME where SME can print the E - Voucher concerned. For SME that are registered before the

date of the 11th. November 2014 but has yet to receive E - Voucher, it will be given by SME Corp in stages within 2 weeks time.

E - Vouchers are a government financial assistance to help the GST registered person to buy or upgrade accounting software certified by the Royal

Malaysian Customs Department. All registered persons are requested to check the status of SME E - Voucher , respectively .

GST shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in Malaysia by a taxable person.

GST is also charged on the importation of goods and services.

A taxable supply is a supply which is standard rated or zero rated. Exempt and out of scope supplies are not taxable supplies. GST is to be levied and

charged on the value of the supply.

GST can only be levied and charged if the business is registered under GST. A business is not liable to be registered if its annual turnover of taxable

supplies does not reach the prescribed threshold. Therefore, such businesses cannot charge and collect GST on the supply of goods and services made to

their customers. Nevertheless, businesses can apply to be registered voluntarily.

Almost all countries collect income tax, which is a percentage of what you earn as an individual. Another way the government gets revenue is by collecting

tax from business operations, like sales tax and duties on items that are bought or sold.

We need to pay tax so that the government can operate. GST is one method of collecting taxes which works better than others.

GST is proposed to replace the current consumption tax i.e. the sales tax and service tax (SST). The introduction of GST is part of the Government's

tax reform programmed to enhance the efficiency and effectiveness of the existing taxation system.

GST is proven to be a better tax system as it is more effective, efficient, transparent and business friendly and could spur economic growth as well as

increase competitiveness in the global market.

GST is capable of generating a more stable source of revenue to the nation because it is less susceptible to economic fluctuations.

It is important to replace the existing SST in order to eliminate its inherent weaknesses such as cascading and compounding effects, transfer pricing

and value shifting, no complete relief on goods exported, discourage vertical integration, administrative bureaucratic red tape, classification issues

and etc.

Various benefits that GST can offer to Malaysian consumers and businesses are:

The revenue from GST could be used for development purposes for social infrastructure like health facilities and institutions, educational infrastructures and public facilities to further improve the standard of living.

Under the current system, some businesses pay multiple taxes and higher levels of tax-on-tax (cascading tax). With GST, businesses can benefit from recovering input tax, thus reducing cost of doing business.

GST is a better and more efficient method of revenue collection for the government. More funds can be channeled into nation-building projects for progress towards achieving a high income nation.

With the GST, taxes are levied fairly among all the businesses involved, whether they are in the manufacturing, wholesaling, retailing or service sectors.

GST will be administrated in a fully computerized environment, therefore speeding up the delivery, especially for refund claims. This makes it faster, more efficient and reliable.

Prices of Malaysian exports will become more competitive on the global stage as no GST is imposed on exported goods and services, while GST incurred on inputs can be recovered along the supplies chain. This will strengthen our export industry, helping the country progress even further.

The current SST has many inherent weaknesses making administration difficult. GST system has in-built mechanism to make the tax administration self-policing and therefore will enhance compliance.

Under the present SST, businesses must apply for approval to get tax-free materials and also for special exemption for capital goods. Under GST, this system is abolished as businesses can offset the GST on inputs in their returns.

GST eliminates double taxation under SST. Consumers will pay fairer prices for most goods and services compared to SST.

Unlike the present sales tax, consumers would benefit under GST as they will know exactly whether the goods they consume are subject to tax and the amount they pay for.

Standard-rated supplies are goods and services that are charged GST with a standard rate. GST is collected by the businesses and paid to the government.

They can recover credit back on their inputs. If their input tax is bigger than their output tax, they can recover back the difference.

How GST is charged at each level of supply chain standard rated supply :

How GST is charged and collected at the wholesale level for standard rated supply :

Computation of GST at all levels of the supply chain for standard rated supply :

| Level of supply | Sales price (including GST at 6%) | Payment to Government |

|---|---|---|

Raw material supplier |

Sales price = RM50.00 |

GST collection = RM3.00 |

GST = RM3.00 |

Less: GST paid =RM0.00 |

|

Total sales price = RM53.00 |

GST payable = RM3.00 |

|

Manufacturer |

Sales price = RM100.00 |

GST collection = RM6.00 |

GST = RM6.00 |

Less: GST paid =RM3.00 |

|

Total sales price = RM106.00 |

GST payable = RM3.00 |

|

Wholesaler |

Sales price = RM125.00 |

GST collection = RM7.50 |

GST = RM7.50 |

Less: GST paid =RM6.00 |

|

Total sales price = RM132.50 |

GST payable = RM1.50 |

|

Retailer |

Sales price = RM156.00 |

GST collection = RM9.36 |

GST = RM9.36 |

Less: GST paid =RM7.50 |

|

Total sales price = RM165.36 |

GST payable = RM1.86 |

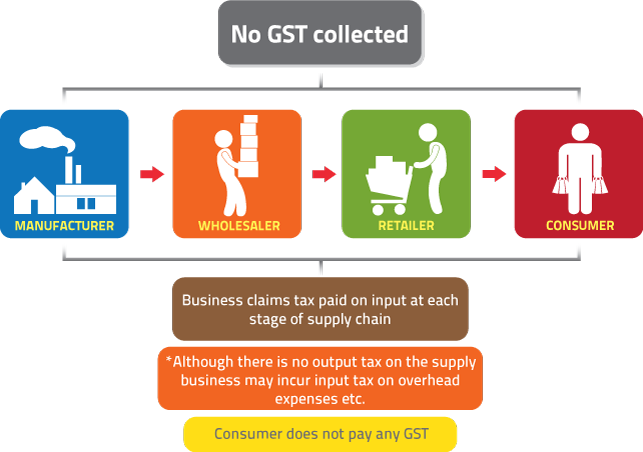

These are taxable supplies that are subject to a zero rate. Businesses are eligible to claim input tax credit in acquiring these supplies, and charge

GST at zero rate to the consumer.

How GST works on a zero rated supply :

How GST works on a zero rated supply at the wholesale level :

Computation of GST on zero rated supply :

| Level of supply | Sales price (including GST at 6%) | Payment to Government |

|---|---|---|

Wholesaler |

Sales price = RM100.00 |

GST collection = RM0.00 |

GST = RM0.00 |

Less: GST paid =RM0.00 |

|

Total sales price = RM100.00 |

GST payable = RM0.00 |

|

Retailer |

Sales price = RM125.00 |

GST collection = RM0.00 |

GST = RM0.00 |

Less: GST paid =RM0.00 |

|

Total sales price = RM125.00 |

GST payable = RM0.00 |

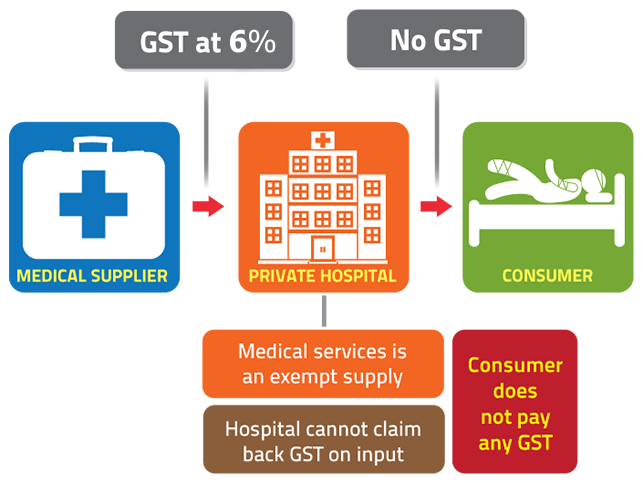

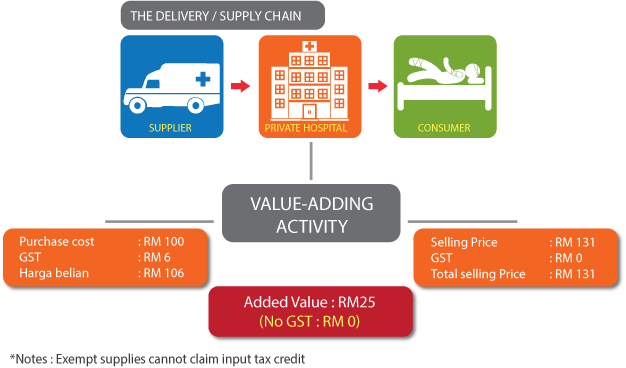

These are non-taxable supplies that are not subject to GST. Businesses are not eligible to claim input tax credit in acquiring these supplies, and

cannot charge output tax to the consumer.

How GST works on an exempt supply :

How GST works on an exempt supply by a service provider :

Computation of GST on exempt supply :

| Level of supply | Sales price (including GST at 6%) | Payment to Government |

|---|---|---|

Raw material supplier |

Sales price = RM50.00 |

GST collection = RM3.00 |

GST = RM3.00 |

Less: GST paid =RM0.00 |

|

Total sales price = RM53.00 |

GST payable = RM3.00 |

|

Manufacturer |

Sales price = RM100.00 |

GST collection = RM6.00 |

GST = RM6.00 |

Less: GST paid =RM3.00 |

|

Total sales price = RM106.00 |

GST payable = RM3.00 |

|

Service provider |

Sales price = RM131.00 |

GST collection = RM0.00 |

GST = RM0.00 |

Less: GST paid =RM0.00 |

|

Total sales price = RM131.00 |

GST payable = RM0.00 |

GST shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in Malaysia by a taxable

person. GST is also charged on the importation of goods and services.

A taxable supply is a supply which is standard rated or zero rated. Exempt and out of scope supplies are not taxable supplies.

GST is to be levied and charged on the value of the supply.

GST can only be levied and charged if the business is registered under GST. A business is not liable to be registered if its annual turnover of taxable

supplies does not reach the prescribed threshold. Therefore, such businesses cannot charge and collect GST on the supply of goods and services made to

their customers. Nevertheless, businesses can apply to be registered voluntarily.

Supplies made by the Government are generally treated as out of scope supplies. No GST will be imposed on the supply made by the Federal Government and State Government such as healthcare services provided by hospital and clinic, education services by primary and secondary school including tertiary education, issuance of passport by the Immigration Department, issuance of licenses and permits by the Road Transport Department and etc.

Rationale:-

Government supplies subject to GST

Specific supplies such as water supply by the State Government and advertising services by RTM will be subjected to GST due to the commercial nature of these services.

Supplies by Statutory Bodies and Local Authorities

Supplies made by Statutory Bodies and Local Authorities will be subject to GST except supply in respect of its regulatory and enforcement functions such as issuing licenses and permits and etc.